Caixin: China to Roll Out Red Carpet for Foreign Financial Firms

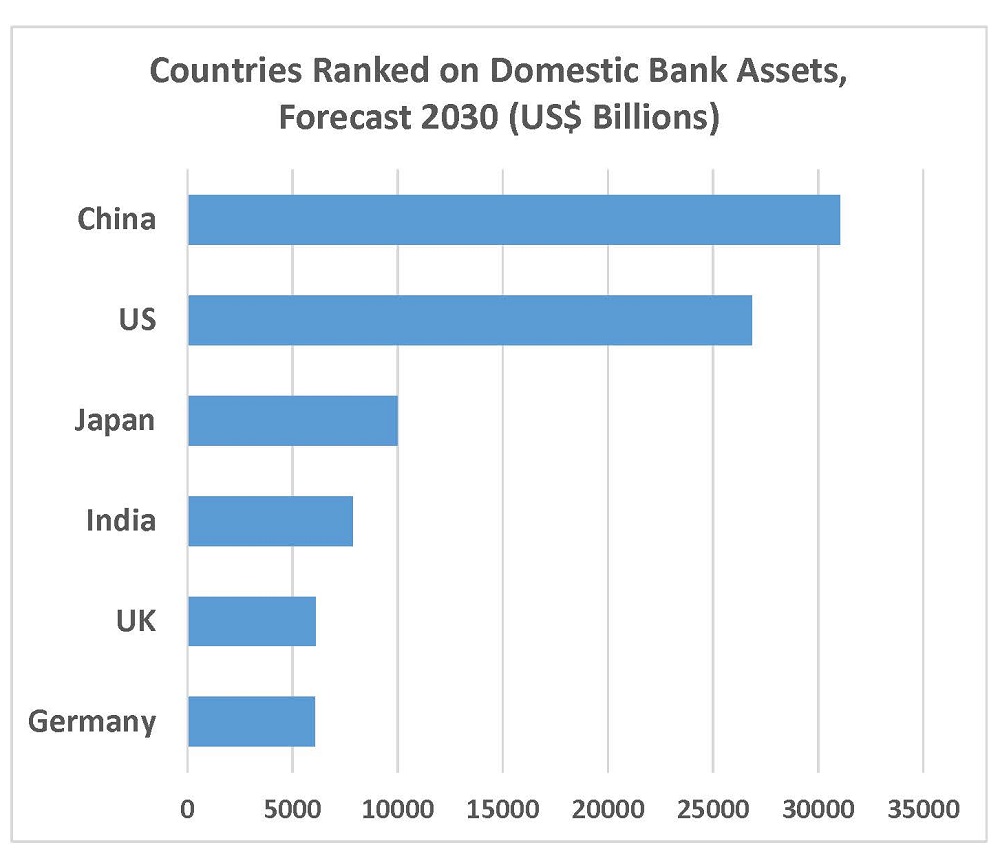

China may do more to open its financial industry to foreign investors, lifting ownership caps for banks as well as securities, funds, and futures industries, according to a team from Caixin. “Sixteen years after China agreed to liberalize foreign access to its financial sector as part of its World Trade Organization accession commitments, overseas investors still complain about barriers restraining their access to the world’s second-largest economy – barriers such as shareholding caps and license controls.” A date has not been set, though the plan is for caps to be eliminated altogether, three years for securities firms and five years for banks. Access to China’s market increased after 2000, then slowed with the 2008 financial crisis: Assets of foreign banks as a percentage of total assets of China’s banking sector fell by nearly 50 percent to 1.26 percent for 2016. “Over the past decade, China’s banking sector has grown into the world’s largest in terms of assets, while the total value of stocks traded on the country’s bourses ranks second globally,” notes Caixin. “Concern over financial risk from mounting bad loans and excessive leverage has grown, and officials have increasingly counted on market liberalization to promote reform, invigorate competition and moderate risks.” Foreign investors are expected to scrutinize the regulations closely. – YaleGlobal

Caixin: China to Roll Out Red Carpet for Foreign Financial Firms

By assets, China’s banking system is the world’s largest, and the government plans to lift caps on ownership and other restrictions to reduce systemic risks

Tuesday, November 21, 2017

Caixin

Copyright © 2017 Caixin Global Limited. All Rights Reserved.