Devalued Yuan Seeks Reserve Currency Status

Devalued Yuan Seeks Reserve Currency Status

JAKARTA: With the US Federal Reserve poised to hike interest rates soon amid a sea of devaluing currencies and quantitiative easing, the US dollar has became the defacto currency of choice among nations. The dollar accounts for nearly 90 percent of all foreign-exchange transactions.

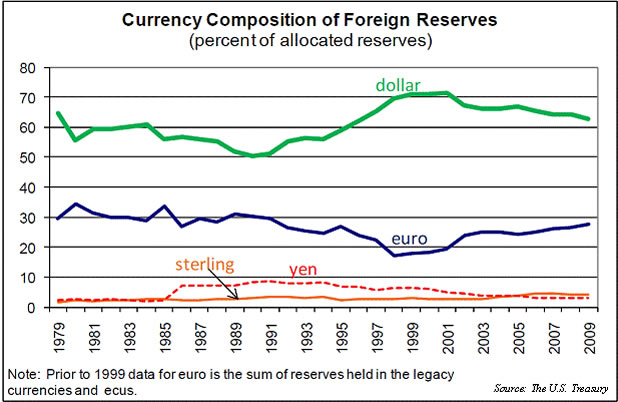

The International Monetary Fund has designated four currencies as reserve currencies available for stabilizing monetary markets: the US dollar, the Japanese yen, the euro and the British pound. The IMF reviews the basket’s composition every five years, and the next one is scheduled for November.

China, the world’s second largest economy, is striving for its renminbi to join that group. To be considered for IMF reserve currency status, a currency must be freely useable in foreign commerce. An IMF report urged delay on the renminibi’s entrance, suggesting the currency should be more responsive to market forces. That spurred a series of devaluations by the Bank of China that rocked global financial markets.

Any inclusion of the renminbi would likely be grounded more in symbolism and politics than economics and amount to no more than 15 percent compared with the 42 percent for the dollar. The renminbi is still loosely pegged to the dollar. If added, the currency would account for 1.1 percent in total world foreign-exchange transactions (see graph).

China’s efforts are centered in demonstrating its status as an equal among world powers, arguably a superpower, to the rest of the world and especially to Chinese citizens.

Yet China’s total debt to GDP is now nearing 300 percent, above the average of most developing countries and even developed ones such as Australia, Germany and Canada. The US total debt to GDP is 333 percent.

The US, with its deeper and transparent markets is simply more capable of handling higher debt loads than secretive, misanthropic Chinese markets which tend to reward big players first and only.

Overextended real estate prices account for the largest share of these debts. Home costs in Shanghai and Beijing come close to rivaling those in Sydney, New York and Paris. Other debt is in the form of non-performing loans to state-owned enterprises, or SOEs. Creation of the Asia Infrastructure Investment Bank may be a possible indicator of this protection of SOEs.These indicators would tend to reinforce a weakening currency strategy.

Other countries face the same challenges. External devaluation alone cannot bring about prosperity. There are also “internal devaluations.” The eurozone is one currency union but a mix of various economies. Unlike Vietnam, Venezuela or Nigeria, the European Central Bank simply cannot devalue externally but must resort to internal mechanisms to achieve balances, which entail reducing labor costs, slashing pensions and reducing social benefits. Greek reforms are emblematic of these challenges. While painful, such internal austerity measures did succeed in keeping Ireland and Latvia in the eurozone.

The United States – much like Europe and Japan and soon China – confronts lurking problems associated with an aging population. The retirement of a critical mass of so-called baby boomers in the United States, about 75 million people born between 1946 and 1964 – will exacerbate the national debt load. Without changes, the US debt is predicted to soar to $20 trillion by 2017 – more than $6500 for every man, woman and child.

Yet, the United States does not need to keep foreign exchange reserves to shore up its public finances. Reserve currency status, with attendant market psychology, continuously ensures the United States, along with a few others like the EU, has a free pass from the problems facing the rest of the world due to weakening currencies and overspending.

Economist Nouriel Roubini has called the dollar “the tallest small midget in the room.” Its recent resurgence over the past two years, despite the liquidity and vast amounts of quantitative easing with the central bank printing money and pumping that into the system, fortify this view. Simply, the US, along with others, prints money in order to reduce debt fundamentals – “more paper to cover the hole.” The Japanese yen and Swiss franc are historically stable and sound currencies, but are not viable alternatives to the dollar. Their total liquidity available for world trade is too tiny.

Brazil, Russia, India, China and South Africa are desperate to diversify away from dollars, but most of these BRICS countries have underlying currency problems, be it trust, historic devaluations, commodity declines or simply inconvertibility. Any potential currency union of that group would be considered at arm’s length especially after the Greek budget fiasco and the lack of honesty on fiscal affairs among eurozone partners.

Russia and Venezuela’s economies, along with many others, are largely driven by fossil fuel exports. A recent downtick in oil prices has produced pandemonium in those weakening currencies. The financial crisis in 1998, largely tied to falling oil prices that wiped out life savings for many and permanently eroded trust in domestic currencies and governments despite abundant natural resources. World risk perceptions still crown the fiat US dollar king.

Argentina, a darling of world economic growth in the late 1950s, has shown that financial mismanagement can derail even the most promising of stories. For Indonesia, Nigeria and others, the prices of hard assets and property in the developing world are baselined in dollars rather than a local currency despite rules to the contrary.

This world addiction for dollars has allowed the US government to largely insulate its citizens and politicians from making needed policy changes. By all traditional economic measures, printing mass amounts of currency and expanding the balance sheets of the US Treasury – bond purchases with created money – since 2009 should have depressed the dollar, weakening it considerably. In fact, the opposite has occured.

In a world of uncertainty, the dollar has risen to the supreme currency of choice against other currencies in the IMF basket of reserve currencies. Many countries took the signal from the US quantitative easing program to print vast amounts of currency on their own, in particular Japan and then Europe, in the vain hope of jumpstarting export-led growth. Every country seems to have something to sell, but few actually want to buy from others with currency wars and protectionism rising.

The effect of all this is that strong reliance on dollars places global economic policy on the shoulders of a US Federal Reserve that may or may not be reflective of macroeconomic conditions in other countries. Most nations will feel the economic change in terms of soaring costs for imports, domestic property bubbles and anything financed in dollars including bridges, toll-roads and powerplants where people pay fees, electric bills and taxes in local currencies that are consistently devalued. Life is getting more expensive and difficult for many due to, at the core, a lack of trust in their own governments’ fiscal regimes. Trusting that US economic policy is better than their own, no matter how misguided.

The key takeaway is that as long as the US dollar remains the currency of trust and use for virtually all world transactions in absence of a viable alternative, it will maintain predominance in global trade, no matter how out-of-synch US economic issues remain. Perceptions and trust are perhaps the true designators of a reserve currency, not macroeconomic fundamentals or economic idealism.

Will Hickey is associate professor and capability advisor for the School of Government and Public Policy in Indonesia.