Dollar Strength Not Born in the US: Financial Times

The US dollar remains strong despite declining growth and bond yields in the United States and the world. Global markets may have more control than the US government over the value of the dollar. “Faced with weak growth in the rest of the world, investors gravitate to US bonds and defensive equities, and the dollar strengthens,” explains Bhanu Baweja for Financial Times. The Trump administration worries about a rising dollar, which makes US exports less attractive in foreign markets. But the dollar cannot shake off its reputation as a safe-haven for investors. The Trump administration could take steps to weaken the dollar, but Baweja points out that a currency war would exacerbate difficulties of “an already fragile international trading system” and this could actually strengthen the dollar. Reducing the value of the US dollar requires stronger global growth, and the United States has targeted China, a key source of such growth. The essay concludes, “If global spillovers from Chinese growth are structurally declining, as we believe they are, then US assets, which are less sensitive to the global cycle than European or emerging markets assets, will see an increased allocation in investor portfolios, keeping the dollar well supported.” – YaleGlobal

Dollar Strength Not Born in the US: Financial Times

The Trump administration may try to force the dollar down, but probably without success – not without global growth offering investors alternatives

Thursday, July 18, 2019

Read the article from Financial Times about the persistence of a strong US dollar.

Bhanu Baweja is chief cross-asset strategist at UBS Investment Bank.

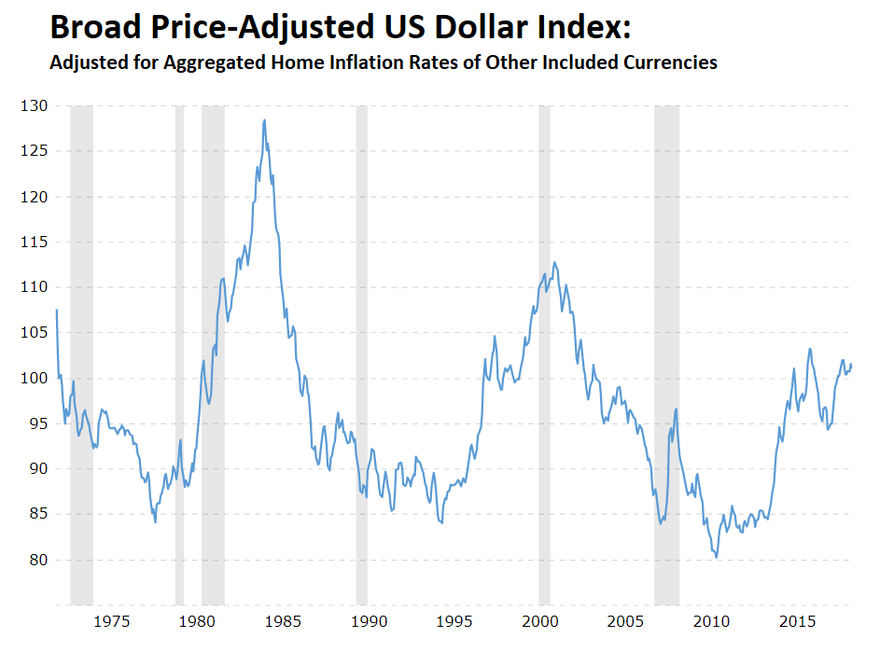

(Source: US Federal Reserve and MacroTrends.net)

Financial Times

Copyright The Financial Times Limited 2019. All rights reserved.