Flashpoint in New Financial War: New Statesman

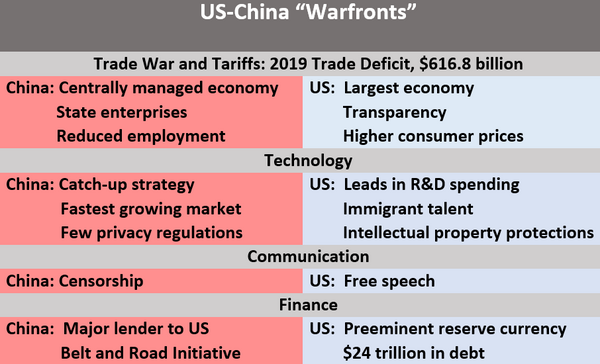

China and the US wage war on multiple fronts – trade, tech, social media and communications. China takes steps to impose a National Security law for Hong Kong and that could extend a new front into finance and weaponization of capital, argues George Magnus for New Statesman. The United States has “the biggest, deepest, most transparent and trusted capital markets subject to the rule of law, and the world’s pre-eminent reserve currency” and US firms of all types continue to pursue Chinese markets. Hong Kong accounts for about 3 percent of Chinese GDP, but it “intermediates capital into and out of China and, importantly, serves as a conduit for much-needed US dollars into China’s financial and economic system,” he explains. “These dollars help finance crucial policies such as the Belt and Road Initiative.” The US, concerned about autonomy eroding for Hong Kong, may take any number of steps to curtail the territory’s special status, including favorable tax, accounting and legal treatment of financial transactions; tariff-free trade; new scrutiny and restrictions on US dollars in transactions; sanctions for individuals; delisting Chinese companies from US stock exchanges and more. US businesses, pursuing market in China share, will protest. – YaleGlobal

Flashpoint in New Financial War: New Statesman

China’s imposition of a strict new national security law could lead the US to rescind Hong Kong’s special financial status

Wednesday, June 17, 2020

Read the article from the New Statesman about rising US-China tensions with a focus on Hong Kong.

George Magnus is a research associate at Oxford University’s China Centre and at SOAS, a former UBS Chief Economist, and author of Red Flags: Why Xi’s China is in Jeopardy.

New Statesman

© New Statesman 2020