France Deals With Globalization Crisis – Part I

France Deals With Globalization Crisis – Part I

PARIS: It is widely recognized that financial markets are imperfect and require some public regulation. But what about markets for internationally traded goods and services? To question such trade is taboo among economists. The few who dare are immediately condemned as “protectionists.” And for economists, protectionism has been the epitome of evil in international economic affairs since the 1930s.

This is strange, as from a conceptual point of view, international goods and services markets are full of what economists call market failures, including:

1. increasing returns leading to global monopolies and oligopolies;

2. economies of agglomeration leading to large concentrations of exporting industries in areas like China’s Shenzhen Special Economic Zone or a concentration of financial services like Wall Street, the City of London, Singapore;

3. massive state interventions, particularly in emerging countries whose policies can approach neo-mercantilism.

As a result, in the last three decades of globalization, the jobs producing internationally traded goods and services have been unevenly distributed: Africa is dramatically short of such jobs. Europe and the US have lost too many of them. In China, they appear to be excessively concentrated in export-oriented firms.

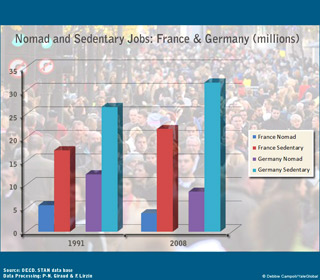

Let’s call internationally traded goods and services that do cross borders “nomadic goods” and those that don’t cross national borders “sedentary goods.” By extension, the people holding jobs can be classified the same way: “Nomadic jobs” are those that directly contribute to producing nomadic goods. In that sense, a “nomad” is not only someone who is internationally mobile, but also someone who directly contributes to the production of nomadic goods like cars, electronic devices, software and financial services.

If a “nomad” loses his “competitiveness,” his or her job disappears from the territory and reappears in another one.

Sedentary jobs are producing sedentary goods that remain in the territory like infrastructure, basic urban services, power generation, and most personal private and public services. If someone having a sedentary job loses his competitiveness, he will be replaced by another sedentary person, and he himself will take a less-qualified sedentary job, as long as the demand for sedentary goods doesn’t change within the territory.

The classification is intuitive and confirmed by simple economic models, that a given territory with numerous rich nomads will have wealthier sedentary workers producing the sedentary goods.

For decades in Europe and the United States, the nomads’ jobs have steadily disappeared, forcing millions of people into the sedentary sector, mainly in poorly-paid service positions, while many of the richest nomads have become much richer. This has led to a widening wealth gap between average nomads and sedentary people and a shrinking middle class, a trend that poses serious political threats, opening the doors to populism and xenophobia.

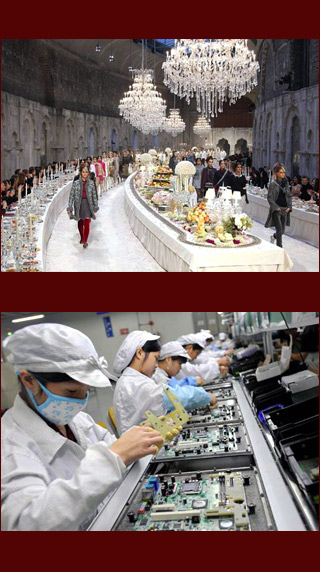

Faced with this challenge, European governments repeat the same mantra: Relief for Europe is to invest in high-tech and other innovative industries, such as luxury goods, fashion and design, regional or national specialties like champagne, and tourism. But, according to a recent study by the McKinsey Global Institute, innovative industries and renowned trademarks account for only 18, 20 and 26 percent of the French, German and US industries, respectively. Moreover, even in these sectors, particularly high-tech, China and India are increasingly competitive.

If these trends continue, rich countries will become like India today where the richest people live alongside the very poor. For example, Mumbai is host to some of the richest Indians, but over 50 percent of the population still lives in slums.

In Europe, the process of deindustrialization has gone too far, and it’s time to reverse it. Europe should keep those segments requiring skilled human and social capital, costly and time-consuming to rebuild once lost – not for standard consumer goods but highly automatized assembly plants of sophisticated manufactured goods like cars.

For such segments of the global value chains, China and India will lose their price competitiveness within 10 to 20 years. Their present competitiveness is based on the structure of their active workforce: a growing minority of nomads whose revenues are improving very fast, but pulled down, at least in the lower segment, by an enormous mass of sedentary people whose low productivity keeps them poor; thus, they sell sedentary goods and services at low relative prices. This is why an Indian software engineer, a Stanford graduate, can enjoy a better lifestyle, with the same wage in dollars, in Bangalore than in Palo Alto.

Letting these value chains disappear in Europe, which will recover price competitiveness within 10 to 20 years, would be an enormous destruction of human and social capital – a big mistake in the long-term management of what is the strongest pillar of the “Wealth of Nations.” Human and social capital actually account for 80 percent of wealth in rich countries.

As for China, it’s chosen an export-driven industrial growth strategy, as South Korea did from the 1960s to 1980s. China, much bigger than South Korea, has hollowed out a large slice of industry in the former industrialized countries. In the meantime, although hundreds of millions of Chinese have been pulled out of absolute poverty, geographic and social inequalities have dramatically increased.

There is an obvious win-win cooperative solution: First, China - and other emerging countries in due time - should rapidly reorient their growth towards their domestic markets. There is no other way to create true middle classes. Second, firms from emerging countries should delocalize massively less qualified nomadic jobs in Africa. Europe could help this move by keeping their borders open to those goods with a sufficient African content. Finally, to maintain its valuable human capital, Europe should stop its deindustrialization and the destruction of its middle class.

The US might choose another way: maintaining specialized world class “nomadic” clusters – many of the best universities, research centers and innovative firms of the world – with the rest of employment made up of sedentary, mainly service, jobs. In this case, the US would end up resembling India today in a few decades with its vast wealth gap.

But Europeans and Chinese may not readily tolerate more inequalities. Witness the growing social unrest in China as people want a greater share of globalization’s benefits and expect the economy to be much more oriented at satisfying the domestic needs. The government claims to want the same, but with a gradual transition.

Therefore Europe, China and Africa should start negotiations and also welcome the US, India and Latin America.

The objectives of such a cooperative strategy could include coordinating exchange rates along with monetary, budgetary and industrial policies.

But in any negotiation, each player must keep at hand a Plan B should negotiations fail. For example, a simple Plan B for Europe might include “reciprocity” – this means treating global firms exactly like China and India do, for example when they require a minimum “local content” for goods to be sold in their territories. Welcome Chinese and Indian goods and services in Europe, if enough of their final value is produced in Europe, much as Japanese carmakers were encouraged to do in Europe and the US in the 1980s.

To optimize the benefits of globalization, nations must establish a much more balanced cross-fertilization of each territory by the nomads from afar.