Global Corporate Tax System: Financial Times

The world’s largest economies can rescue globalization by tackling inequality and reforming the international taxation system. In 2013, the OECD improved information exchange. Still, multinationals, especially digital firms, rely on subsidiaries to minimize taxes with as much as 40 percent of profits going to tax havens. India is among the countries pressing for reform and suggesting large markets could change laws unilaterally, forcing multinationals to manage numerous tax systems. “That gives urgency to the new proposal from the OECD Inclusive Framework — a body of 129 member states — to allow countries to estimate the taxes due from multinationals based not only on their local business but also on their worldwide profit margins,” explains José Antonio Ocampo. “This would, for the first time, treat such companies as what they really are: integrated businesses making profits in a global marketplace.” Developed and developing nations are divided: The first group would benefit from a minimum corporate tax to avoid a race to the bottom; the second would benefit from a proposal basing taxes on metrics like sales, employment and digital users. – YaleGlobal

Global Corporate Tax System: Financial Times

Nations consider proposals to reform global taxation and how to prevent multinational corporations from finding tax havens

Friday, July 12, 2019

Read the article from Financial Times about proposals for global tax reform.

José Antonio Ocampo, a board member of Colombia’s central bank and a Columbia University professor, chairs the Independent Commission for the Reform of International Corporate Taxation.

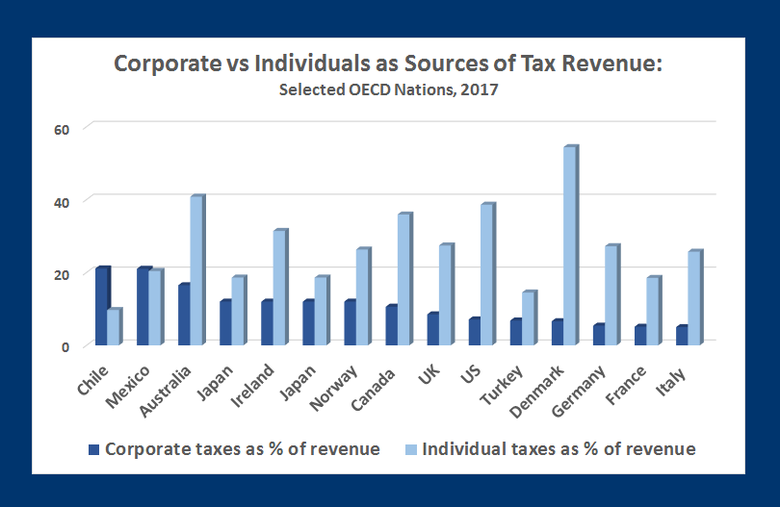

Funding government: OECD countries tend to rely on revenue from consumption taxes, social insurance taxes and individual income taxes rather than corporate income taxes and property taxes (Source: OECD and Tax Foundation)

Financial Times

The Financial Times Limited 2019. All rights reserved.