Limits of Russian Strategy in Middle East: RAND

Limits of Russian Strategy in Middle East: RAND

Read the article from the RAND Corporation about Russia’s quest for influence in the Middle East.

Becca Wasser is a senior policy analyst at the RAND Corporation, where her primary research areas include wargaming, international security, and U.S. defense and foreign policy in the Middle East.

Also read “Russia in the Middle East” from the Carnegie Endowment for International Peace:

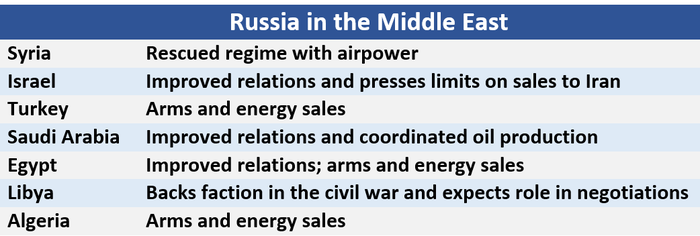

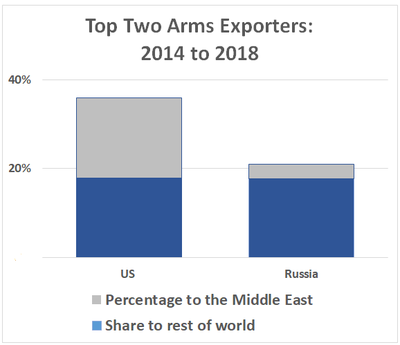

Competitors: The US sold 36 percent of the world’s weapons, about half to the Middle East, between 2014 and 2018: Russia sold 21 percent, with 16 percent of that to the Middle East; top buyers for the US during that period were Saudi Arabia, Australia and the United Arab Emirates and top buyers for Russia were India, China and Algeria (Source: Stockholm International Peace Research Institute, March 2019)