Project Syndicate: America’s Supply-Side Scam

A US tax proposal delivers big tax cuts for the wealthiest citizens. US companies already pay a low effective corporate tax rate. US corporations already rank high in competitiveness. Stephen S. Roach – author, senior lecturer at Yale University and former chairman of Morgan Stanley Asia – argues the country cannot afford tax cuts that will expand the country’s large deficit. A low savings rate limits US ability to manage multi-year deficits. Previous big tax cuts took place when the savings rate was near 10 and 4 percent, while the current net domestic rate is now less than 2 percent of national income. The United States will have little choice but to borrow money from surplus savers in China and elsewhere. Tax cuts will add to current-account deficits and the trade deficit. “Far from a recipe for greatness, the Trump fiscal gambit spells serious trouble,” Roach writes. “Lacking in saving, outsize US budget deficits point to sharp deterioration on the balance-of-payment and trade fronts.” Tax cuts combined with the low savings rate ensure a weakened United States with less money for government programs and services and greater challenges for future generations and the US Federal Reserve that must manage the consequences of such imbalances. – YaleGlobal

Project Syndicate: America’s Supply-Side Scam

Proposed US tax cuts are no recipe to "make America great again" and outsize budget deficits spell serious trouble on the balance-of-payment and trade fronts

Tuesday, November 28, 2017

Stephen S. Roach, former chairman of Morgan Stanley Asia and the firm’s chief economist, is a senior fellow at Yale University’s Jackson Institute of Global Affairs and a senior lecturer at Yale’s School of Management. He is the author of Unbalanced: The Codependency of America and China.

Read an excerpt.

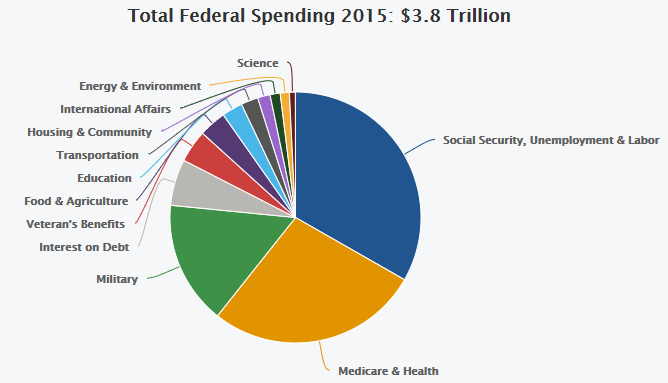

Source: US Office of Management and the Budget, National Priorities Project

Project Syndicate

© Project Syndicate - 2017