Renminbi Revaluation Won’t Trigger a Shopping Spree

Renminbi Revaluation Won't Trigger a Shopping Spree

NEW HAVEN: As China prepares to revalue the renminbi this summer, perhaps initially by about 5 percent, it is natural to ask: Will its revaluation correct the global imbalances that everyone talks about? In particular, will such a policy change by China return jobs to the United States while reducing trade imbalances? The answer is no.

Revaluation of the renminbi will simply result in a shift of manufacturing among emerging markets, leaving the US with a somewhat smaller trade deficit, higher prices for imported goods and higher interest rates, but not necessarily higher levels of employment. Neither is it likely to increase domestic Chinese consumer spending that the world wants to see. China’s domestic spending will rise only when the government releases its hold on the economy and households receive a larger share of GDP.

In preparing to travel for study at Yale 24 years ago, I spent almost a day in Beijing, sending a telegraph to the US. Back then, a telephone call to the US cost $4 a minute, and there were only two places in Beijing for making international calls! Cross-Pacific communications were slow and difficult, and the information flow was truly limited. Costs and barriers to trade were so insurmountable that though the average wage of a Chinese worker was 40 times less than that of an American, there was little outsourcing pressure for American manufacturing.

However, with the internet and mobile phone, cross-Pacific communications today are not only virtually free, cross-continent shipping costs also low. Even if the renminbi were to appreciate by 50 percent, raising Chinese labor costs to 10 times less than those in the US, manufacturing would still not return to America.At most, US retailers would source not from China but from other emerging economies. Revaluing the renminbi won’t affect America’s trade deficit or employment as wished for.

A real solution to the global-imbalance challenge lies in China’s increasing its domestic private consumption, as encouraged by almost every commentator in and outside China. The challenge is definitely not that, as some suggest, Chinese people don’t like to spend. They do as much as others.

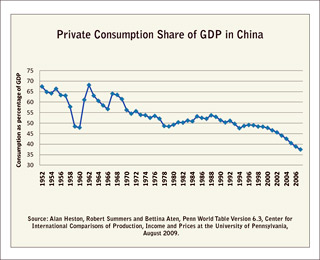

The fact is, according to the Penn World Table, in 1952 and prior to China’s attempt to build socialism by nationalizing land and enterprises, private consumption was 67.4 percent of GDP, not much below America’s 71 percent today. Private consumption dropped precipitously during the Great Leap Forward experiment, before rising back to a higher level. Since 1968 it steadily fell, and by 1978, right before market-oriented reforms started, this ratio dropped to 48.7 percent. In 1997, it stayed at 49 percent. By that time, some Chinese economists had recognized the problem of overdependence on both investment and export and began calling for policy changes, to make private consumption a more important driver of future growth. But, private consumption continued to drop and is now just above 35 percent of GDP! Why?

Reasons often mentioned for the challenges in boosting private consumption in China include people hanging on to their savings in the absence of an adequate social safety net and the lack of sufficient financial products to insure against future uncertainty. Depressed interest rates for bank deposits, a means of subsidizing the state sector, amount to a transfer of income out of households, which also negatively affects private consumption. But more fundamentally, private consumption has failed to grow in pace with China’s GDP, because the Chinese economy is still largely state-owned and because government taxation is, in the absence of functioning democratic institutions – taxation without representation – virtually unchecked.

Too much of both China’s wealth gain and national income goes to government coffers of all levels, leaving households an increasingly lower share of GDP to spend. Officially, China’s state-sector output is only about 35 percent of GDP. But that is severely understated since China does not count as state-owned enterprises (SOEs) joint-stock companies that are directly or indirectly majority-owned by multiple SOEs. If one counts enterprise ownership, assets and land, the government owns between 60 and 70 percent of the country’s productive wealth. Yes, the last 30 years of fast growth has meant higher valuation of land and other assets. But much of that wealth gain goes to the government coffers and only a fraction goes to households.

State ownership is a major factor depressing private consumption growth in China, because it prevents households from directly benefiting from land-value appreciation, enterprise profits and capital gains. One might think that state ownership benefits all and that the SOE profits and state-asset appreciation serve to reduce or eliminate taxation on citizens’ income. But, in China, taxation power is mostly in the hands of the executive branch, the State Council, and has rarely been checked by the National People’s Congress. Not surprisingly, between 1995 and 2007, government tax revenue – not including SOE asset and land sale proceeds – increased by 6.7 times, while urban residents’ per-capita disposable income grew by 1.6 times and rural residents’ by 1.1 times. For this period, government fiscal revenue increased at twice the GDP growth rate, but the average household income grew below the GDP rate.

With the government share of national income expanding at such an uncontrolled pace, it is no wonder that the government does not need the SOEs to turn in profits or capital gains from asset sales. Neither does the National People’s Congress put pressure on SOEs to turn in profits. As a practical matter, the congress is in session only once a year for 10 days and its Standing Committee holds no public hearings to hold the SOEs accountable. Not surprisingly, the SOEs retain profits and asset sale proceeds, re-investing as they wish. This explains why, while China’s aggregate savings as a percentage of GDP rose from 41 percent in 1992 to the recent level of 51 percent, of the 10 percentage-point gain, seven points were due to increases in enterprise savings and the remainder due to the rise in government savings, whereas private savings stayed unchanged at around 22 percent of GDP.

In short, state ownership of assets, coupled with the lack of functioning democratic institutions to constrain taxation, creates the following mechanism: As China’s economy grows, both national income and asset value grow. But the majority of the wealth gain and an increasingly larger share of the national income go to the government coffers, which through SOEs and local governments translates into ever-increasing investments in industry and infrastructure, further expanding the country’s production capacity. At the same time, as households’ share of national income declines, private consumption relative to GDP must go down. This only exacerbates the imbalance between domestic-production capacity and demand, making China more dependent on exports and requiring the renminbi to stay low.

China’s low consumption growth, currency policy and high trade surplus are a result of its political-economic system.

State ownership and control of resources in the past allowed China to industrialize fast. But now state control is a fundamental obstacle to desired structural transformation: As it acts to depress China’s private-consumption growth, it is also partly responsible for the global imbalances. Therefore, while a revalued renminbi can superficially adjust the international trade structure, privatizing state-owned assets and greater say for taxpayers in government budgeting and fiscal policy can ignite a fundamental correction process in China that would also benefit the global economy.

Zhiwu Chen is a professor of finance at the Yale School of Management.