Renminbi Undervalued? Think Again

Renminbi Undervalued? Think Again

NEW BRUNSWICK, NJ: In its semi-annual report to Congress in mid-April, the US Treasury did not declare China a “currency manipulator,” which could have triggered mandatory retaliation, but still singled it out among US trading partners for currency practices stating that the renminbi exchange rate “remains significantly undervalued.” China, coping with wage inflation and a credit crunch, is unlikely to appreciate its currency any more than it has already done so far.

For more than a decade, Washington has pressured China, alleging an undervalued currency. An undervalued yuan or renminbi made Chinese exports cheap in dollars – hence a flood of low-cost imports from China. At the same time, an undervalued currency made imports coming into China artificially more expensive – thus inhibiting imports and giving protection to Chinese companies potentially competing with imported goods. No surprise then that the annual trade deficit suffered by the United States against China has recently been of the order of $300 billion per year. Washington alleges that the flood of Chinese imports takes away jobs from the United States, and the undervalued renminbi inhibits exports from the US to China that would otherwise have occurred with an “appropriately valued” Chinese currency.

But what is “appropriately valued” is a question economists find difficult to answer. The Purchasing Power Parity Theory, or PPP, suggests that, in the absence of distortions such as government manipulation of exchange markets or “natural” distortions caused by exogenous market conditions such as interest-rate differentials, exchange rates would then reflect the true relative purchasing powers of the two currencies.

Such a distortion-free world does not exist. Emerging countries such as China in effect manage or dictate their currency value. Interest rates set by central banks, such as the US Federal Reserve, swing currency rates. “Hot money” flowing over to a currency offering higher returns tends to lift that currency’s value. For example, for several years higher interest rates set by the Australian central bank, as well as their commodity boom, artificially boosted the value of the Australian dollar to record highs as liquid capital, or “hot money,” in exchange markets sold the US dollar and demanded the Australian dollar.

So is it fair to accuse the Chinese government?

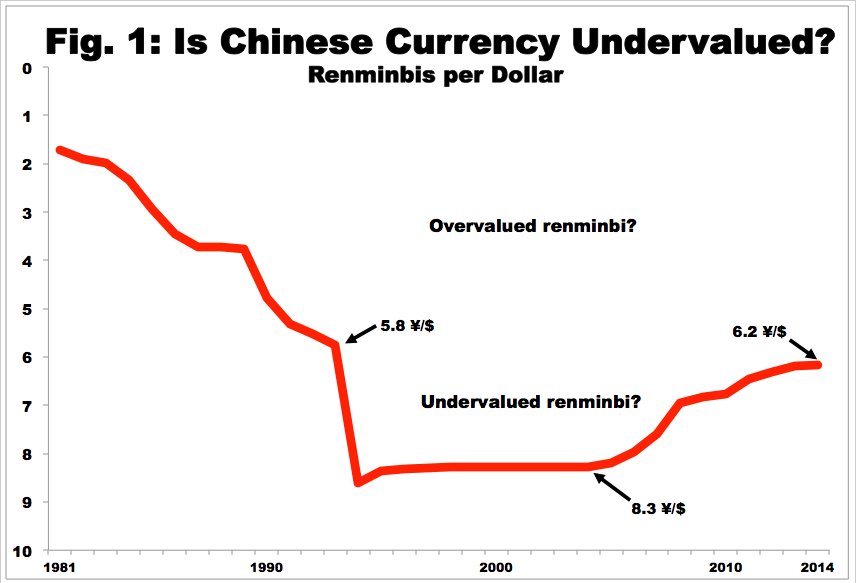

Let us take a long historical perspective. Few remember that, up to 1982, the official rate was less than 2.0 renminbi per dollar (see Figure 1). At that exchange rate, China could hardly export much because their exporters could only convert $1 dollar into ¥2. Exporting was not worth it. But after 1984, the Chinese government embarked on massive devaluations, especially in 1993 and 1994, when the renminbi was suddenly made to plunge from 5.8 to 8.8 per dollar. Under government control, the renminbi then remained flat at ¥8.27 per dollar for more than a decade. A Chinese exporter who earned $1 dollar could convert it at the bank into a gratifying ¥8.27. An export boom was in progress, aided also the reorganization, privatization and increased efficiency of Chinese manufacturers after 2001. By the same token, Chinese importers had to pay a frightening ¥8.27 to import $1’s worth of goods. Imports were crimped. Chinese companies making products that substituted for imports enjoyed considerable protection.

The undervaluation of the renminbi can be explained in one overarching social objective in China: “Jobs, jobs, jobs” – on the export front as well as jobs in sectors protected against imports.

Under increasing pressure from Washington starting in June 2005, the Chinese government began gradually and grudgingly to appreciate their currency. By early 2014, the renminbi had appreciated by more than 35 percent over its June 2005 rate against the dollar. For some Chinese exporters, a 6.1 renminbi/dollar rate meant vanishing profit margins. Profits equal “Revenues minus costs.”

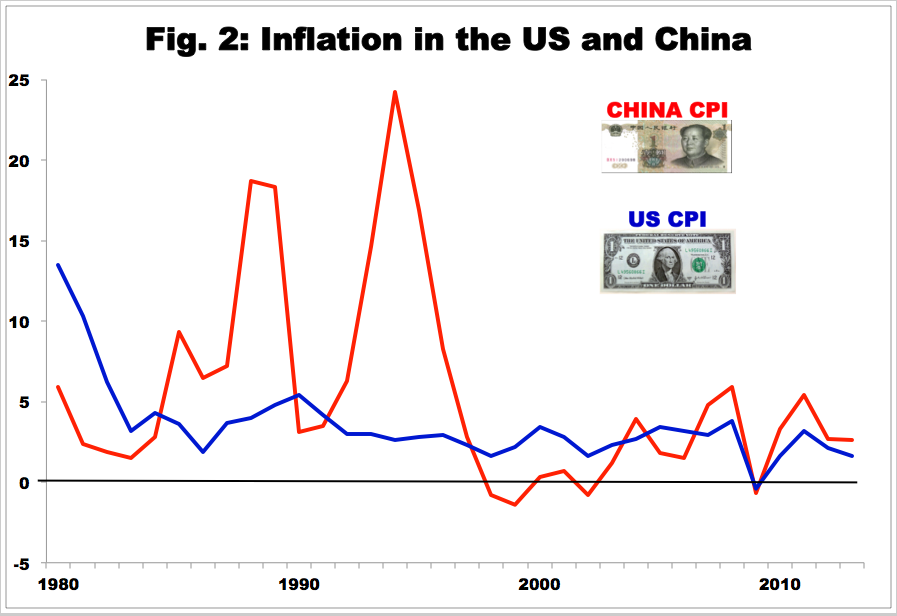

As the renminbi appreciates, revenues for Chinese exporters mean $1 earned converts into fewer renminbi at the bank. At the same time, costs have risen in China – especially with inflation significantly higher than US inflation over the 1981-2013 period (see Figure 2) . Although since 1996 overall inflation in China has been comparable to the US, Chinese manufacturers have had to pay sharply escalating costs for materials, components and wages, which have recently been rising at 18 percent annually along China’s eastern seaboard where most of the country’s manufacturing takes place. For some manufacturers any renminbi exchange rate stronger than 6.0 would mean going into the red. Manufacturers suggest that the Chinese currency has appreciated enough, “appropriately valued” at around 6.1 renminbi per dollar. Already, many Chinese manufacturers have abandoned China and shifted operations to less expensive Vietnam.

In March, though, “…China's central bank … intervene[ed] regularly to push down the value of its currency,” and in April “The U.S. put China on notice that … Beijing's efforts to devalue the yuan represent a shift in policy that could start a round of competitive devaluations,” notes the Wall Street Journal. The United States seeks further renminbi appreciation, hoping to reduce Chinese imports into the US and boost US exports.

Unlike economic models, real life is often messy. Further rise in the strength of the renminbi may only mean that many Chinese manufactures become uncompetitive. But that does not mean imports coming into the US will decline. Production can shift, and that has already started, to Vietnam and Bangladesh. A small but growing fraction of outward foreign direct investment from China is Chinese companies shifting production to other Asian countries. So imports into the US could continue unabated from new locations. As far as US exports to China increasing because of a stronger renminbi or weaker dollar, that may happen, but only marginally. Given the already-automated nature of US manufacturing, an increase in export volume will not substantially increase US jobs.

The US also fears that devaluation by China may trigger “competitive devaluations” in other Asian nations. China’s would-be rivals like Vietnam, India, Indonesia and Bangladesh would love to get manufacturing jobs that are no longer viable in China. And many, like Vietnam, have been actively devaluing their currencies in order to make their exporters more competitive in world markets.

Between 2008 and 2013, the Vietnamese dong was devalued from around 16,000 per dollar to around 21,000 – representing a 31 percent increase in local currency or dong earnings to Vietnam’s exporters. Of course, the Vietnamese would deny that this was a competitive move, because their domestic inflation was also roughly the same, thereby nullifying the devaluation advantage.

Moreover, shifting factories from one nation to another is easier said than done. Managers must account for more than production costs. Consider India, whose nominal labor rates are comparable to those in China. Indian entrepreneurs and engineers are just as capable. Yet India’s manufacturing base is less than a quarter the size of China’s because of strangling bureaucracy, inadequate roads and undeveloped port infrastructure.

So China will remain the “factory to the world” for a while – especially as the Chinese government resists pressures to continue its past policy of currency appreciation. However, a long-term transition may be underway, whereby China eventually escapes the trap of being just assembler and purveyor of low-margin manufactures to the world and moves into higher-value portions of the value chain such as R&D and global brand development. Meanwhile do not expect further appreciation of the renminbi in the near future.