The Tale of Two Middle Classes

The Tale of Two Middle Classes

WASHINGTON: Behind all the handwringing in the West about a declining middle class and growing income gap lurks a stark fact – while a new middle class has emerged in resurgent Asia, middle classes in the West have seen no or very little improvement. Globalization may have succeeded in creating wealth, but its failure to enrich the middle class in the West risks pushing western governments to turn their backs on globalization through trade barriers and anti-immigration policies.

The period of globalization extending roughly from the late 1980s to today can be described as a period of the two middle classes and their economic trajectories. One, relatively poor, did well, and another, quite well off, did poorly.

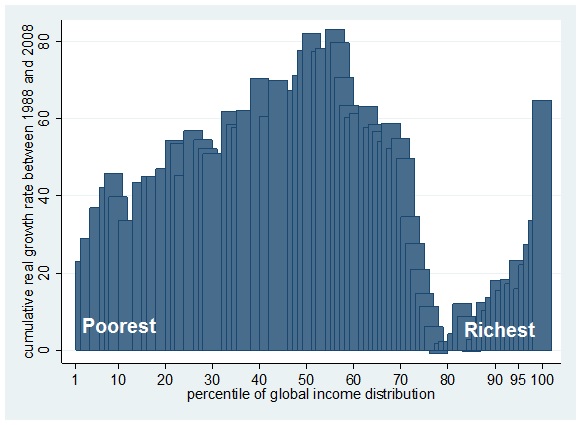

To see that in actual numbers, consider Figure 1. The vertical axis shows the cumulative real income gain, in percent, between 1988 and 2008, and on the horizontal axis global income percentiles, ranging from 1, the poorest 1 percent of the people in the world, to 100, the global top 1 percent. The middle group, those between the 50th and 60th percentile on the horizontal axis, shows real gains with income almost doubling in the two decades. The other group, those richer, around the 80th to 85th percentile registered almost no growth.

The group that did very well was much poorer than the group whose incomes stagnated. In effect, the first group – “the winners” of globalization – had incomes ranging between $3 and $8 international dollars, that is, dollars of equal purchasing power across the globe, per person per day, amounts so low that in western countries virtually no people subsist on so little or amounts that are barely in the territory of what, again using rich world’s standard, is considered the lower middle class.

Thus while many relatively poor people did well during this latest globalization episode, those somewhat richer may have more complaints. People around the 80th global percentile, with incomes ranging from $13 to $27 international dollars per day, saw few improvements. Their incomes were stagnant or barely increasing.

Nine out of ten people around the global median, the “winners” of globalization, are from “resurgent Asia.” They are people from rural China, including some 150 million who have seen their real incomes increase by a factor of 2.5; rural and urban Indonesia, 40 million people whose real incomes doubled; or urban India, 35 million people with increases in excess of 50 percent. There are also workers from Vietnam, Philippines and Thailand. These “winners” belong to the middle or upper parts of their own countries’ income distributions.

On the other hand, those who did not see much of a gain in income are predominantly from the advanced economies. Lower income groups from three big rich countries particularly stand out: the US, Germany and Japan. The average real gain of the lower bottom half of US income distribution was 22 percent – that is, growth of less than 1 percent annually. For Germany it was a mere 4 percent, and Japan showed negative growth.

Suppose that the gains of the Asian middle class and the stagnation of the rich world’s middle class incomes are somehow related – be it through trade that depresses wages or pushes low-skilled into unemployment, or through outsourcing to low-wage economies – then the comfort that accompanies news of globally good changes evaporates. People might accept lack of income growth for a noble cause or a reason so abstract that there is no recourse. But if the cause is relatively concrete and if losses are linked to others’ gains, even if these others are less well-off, the workers with stagnant wages are less willing to accept the outcome.

Moreover, the workers in the advanced economies do have the channels through which to manifest their discontent: political activism, representatives in government and the media. They can express their concerns and push for remedies.

This dissatisfaction, if translated in a derailment of globalization through greater protectionism, new anti-immigration policies, capital controls, or various enervating requirements like “domestic content” could lead to a pause in income gains realized by the poor and the middle classes in Asia. Such a populist response in the West – evident in Europe with the UK Independence Party, Front National, Alternativ für Deutschland, Five stars, or True Finns – directly grows on the back of middle-class dissatisfaction. In scenario portrayed by populists, the two middle classes, one still relatively poor in Asia and the other relatively rich in Europe, North America and Japan are linked like communicating vessels: If one improves, the other loses, or so the message goes.

This is not a zero-sum game though, because total global income increases, but the relative gains are unequally apportioned between the two middle classes.

The populists warn disgruntled voters that economic trends observed during the past three decades are just the first wave of cheap labor from Asia pitted in direct competition with workers in the rich world, and more waves are on the way from poorer lands in Asia and Africa. The stagnation of middle-class incomes in the West may last another five decades or more.

This calls into question either the sustainability of democracy under such conditions or the sustainability of globalization.

If globalization is derailed, the middle classes of the West may be relieved from the immediate pressure of cheaper Asian competition. But the longer-term costs to themselves and their countries, let alone to the poor in Asia and Africa, will be high. Thus, the interests and the political power of the middle classes in the rich world put them in a direct conflict with the interests of the worldwide poor.

These classes of “globalization losers,” particularly in the United States, have had little political voice or influence, and perhaps this is why the backlash against globalization has been so muted. They have had little voice because the rich have come to control the political process. The rich, as can be seen by looking at the income gains of the global top 5 percent in Figure 1, have benefited immensely from globalization and they have keen interest in its continuation. But while their use of political power has enabled the continuation of globalization, it has also hollowed out national democracies and moved many countries closer to becoming plutocracies. Thus, the choice would seem either plutocracy and globalization – or populism and a halt to globalization.

Another solution, one that involves neither populism nor plutocracy, would require enormous effort at the understanding of one’s own longer-term self-interest. It would imply more substantial redistribution policies in the rich world. Some of the gains of the top 5 percent could go toward alleviating the anger of the lower- and middle-class rich world’s “losers.” These need not nor should be mere transfers of money from one group to another. Instead, money should come in the form of investments in public education, local infrastructure, housing and preventive health care. But the history of the last quarter century during which the top classes in the rich world have continually piled up larger and larger gains, all the while socially and mentally separating themselves from fellow citizens, does not bode well for that alternative.