Wanted: Equal Opportunity Globalization

Wanted: Equal Opportunity Globalization

NEW YORK: The rise and electoral success of populist politicians in the West have reopened questions on the effects of globalization – in simplest terms, whether uneven distributional effects of globalization are to blame for widespread dissatisfaction in wealthy countries or does the fault lie with domestic policies or other factors. The responses will shape globalization of this century and could offer remedies for popular discontent.

First, the facts. There is no doubt that the growth rates of the bottom halves of income distributions for rich countries have been low over the past 25 years. This stands in contrast to the high growth rates of Asian middle classes – people poorer than the Western middle class but with whom Western workers may be competing for jobs – and the so-called top 1-percenters. Consider real per-capita growth for the middle 10 percent (middle decile) of rich countries. From 1988 to 2011, average annual growth for this group was 0.5 percent in the United States and Germany, 1.7 percent in France and 1.9 percent in the United Kingdom. Over the same period, the middle deciles in urban and rural China have grown by 6 and 8 percent per annum, respectively, 4 percent in Thailand and 8 percent in Vietnam.

Broadly, the average income growth of a median household in Asia was about four times as high as one in the West.

Perhaps such a difference in outcomes would not have mattered so much to the Western middle classes if slow growth rates were shared in each nation. But that was not the case: The top decile has seen incomes rise by more than 3 percent per annum in the US and by more than 4 percent in the UK. Moreover, the disproportion increases with level of income. Those with yet higher incomes in the West, the famous top 1 percent, enjoyed even higher growth rates during the past 25 years.

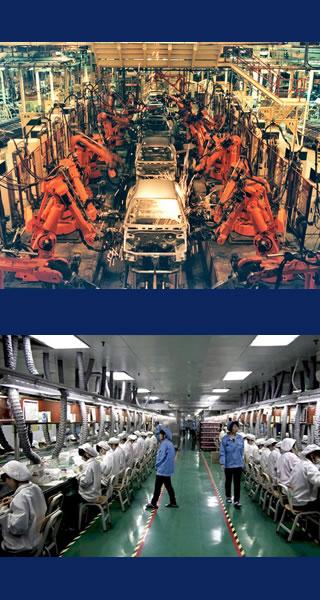

The middle class of the rich world thus found itself squeezed between the poorer, but fast-growing Asian middle and the much richer and also fast-growing domestic top 1 percent – and many blamed globalization.

How to apportion the blame? While the facts are incontrovertible, the causes are not. There are three possible explanations for the uneven growth: technological change driving productivity up among highly-skilled workers compared to the low-skilled, globalization making Western workers uncompetitive in comparison to Asians, or policies that favored the rich through tax cuts.

A policy response to popular anger over globalization depends on the principal cause. If technological change is the cause, there is little governments can do other than compensate the losers. They cannot order technological change to be of one kind and not another. If it is globalization, then governments can take steps to reverse globalization in some segments by limiting openness to trade or free movement of capital. If the problem is economic policy, then governments are the lead culprit.

The three factors cannot be analytically separated. Empirical attempts to disentangle the effects of globalization from technological change have been inconclusive, and the exercise is futile.

Technological change and globalization go hand in hand. Researchers cannot measure inequality as if there had been no globalization while technological progress went on as before. Technological progress responds to incentives and what globalization offers. Innovations are embodied in new products and services, in new laptops or smartphones, and how these are produced depend on globalization. If labor costs were higher – for example, if US producers could not rely on low-cost foreign supply chains – then some high-tech machines, whether assembly robots in manufacturing, precision GPS chemical applicators for the agriculture industry or automated longwall shearers in the mining industry, may not exist at all. Producers and consumers would have simpler machines and goods.

Moreover, the products themselves push new waves of technological progress in specific directions. If the iPhone was not relatively affordable for about 3 billion customers, there would be little commercial interest in creating new applications – and there would be no Uber or growing gig economy that relies on it. Widespread technology was made possible not just by technological progress in Silicon Valley but also the ability to outsource production to low-wage locations. And that in turn has fed into new technological advances. For Uber is little more than the old-fashioned gypsy cab, glorified with new technology and magnified to the global scale.

Likewise, economic policy cannot be meaningfully separated. The principal reason why tax rates were reduced lies in mobility of capital and highly-paid individuals.That mobility is made possible by globalization, with funds easily moved around the world, and by technological progress that allows individuals to work remotely, sometimes thousands of miles from what would have been their workplace in the old-fashioned world.

For these reasons, distributional outcomes must be regarded as the products of interrelated forces of all three phenomena – technology, globalization and economic policy. Taking any two as given and changing the third may be an interesting mental exercise, but has no meaning in the real world.

Solutions are not easy. A basic contradiction of the age of globalization is that economic outcomes for increasing numbers of people are determined at the global level, while political action takes place within nation-states. National governments are put in the position of doing mop-up operations for whatever category of workers is affected by lower wages or layoffs that in turn may be due to new ways of making goods or rendering services invented in China, India, United States or elsewhere.

But it could be argued that this has always been the case. British competition destroyed Indian textiles in the late 19th century. What is new, however, is the scale of such globally driven changes that can emanate from any part of the globe and spread much more rapidly than in the past.

Middle classes went along with globalization as long as they anticipated tangible benefits or so long as the numbers of the disaffected were insufficient to be a credible political force. But that has changed, as demonstrated by Britain’s vote to withdraw from the European Union and the US election of Donald Trump.

What are the governments in the wealthiest nations then to do, short of trying to reverse parts of today’s globalization and in the process shrinking their own growth rates as well as those of emerging-market economies. There are better solutions.

Remedies for reduced inequality of the 20th century won’t work in the 21st century. The old remedies included mass education, large unionized labor and tax-and-spend policies. All of these have reached their limits.

A more promising avenue for dealing with inequality in rich countries for the 21st century is to reduce inequality in human and financial capital endowments. This implies, first, reversing the currently extraordinary high concentration of capital assets by giving the middle classes fiscal and other incentives to invest and own assets and, second, equalizing access to high-quality education which is increasingly monopolized by the rich.

If inequality at the pre-distribution stage is less, then the government’s redistributive role can be smaller. Such nations can be more agile in global competition because they won’t have to permanently fret whether the political consensus behind such policies may collapse at any point. The policy can be summarized under the title of globalization with equalization of domestic opportunities.

Branko Milanovic is an economist with the Graduate Center, City University of New York, and Luxembourg Income Study. He is the author of Global Inequality: A New Approach for the Age of Globalization.