World Bank Warns of Global Debt Crisis: Guardian

Global economic growth continues, fueled by low interest rates and increasing debt. The high interest rates make debt more manageable, but may not stave off financial crisis. “Total emerging and developing economy debt reached almost 170% of gross domestic product in 2018 – or $55tn (£42tn) – an increase of 54 percentage points of GDP since 2010,” reports Larry Elliott for the Guardian. “The World Bank said financial turmoil in emerging and developing economies was one of the threats to its forecast of a slight strengthening of global growth this year, from 2.4% to 2.5%.” China represents most of the debt increase for emerging economies, and the World Bank suggests the large, fast and broad-based. Elliott concludes that reducing debt helps prepare for financial shocks, along with “building resilient monetary and fiscal frameworks, instituting robust supervisory and regulatory regimes, and following transparent debt management practices.” – YaleGlobal

World Bank Warns of Global Debt Crisis: Guardian

World Bank economists warn that rising debt can precede financial crises; the current wave is largest, fastest, most broad-based buildup since 1970s

Thursday, January 9, 2020

Read the article from the Guardian about the World Bank’s analysis of global debt.

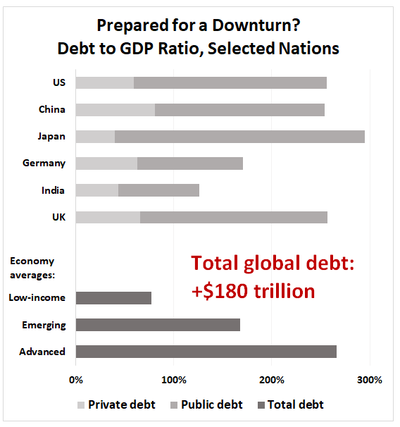

Imbalances: The US, China and Japan account for more than half the world’s debt (Source: IMF, 2019)

The Guardian

© 2020 Guardian News & Media Limited or its affiliated companies. All rights reserved.