Unprecedented Wipeout for Oil: Bloomberg

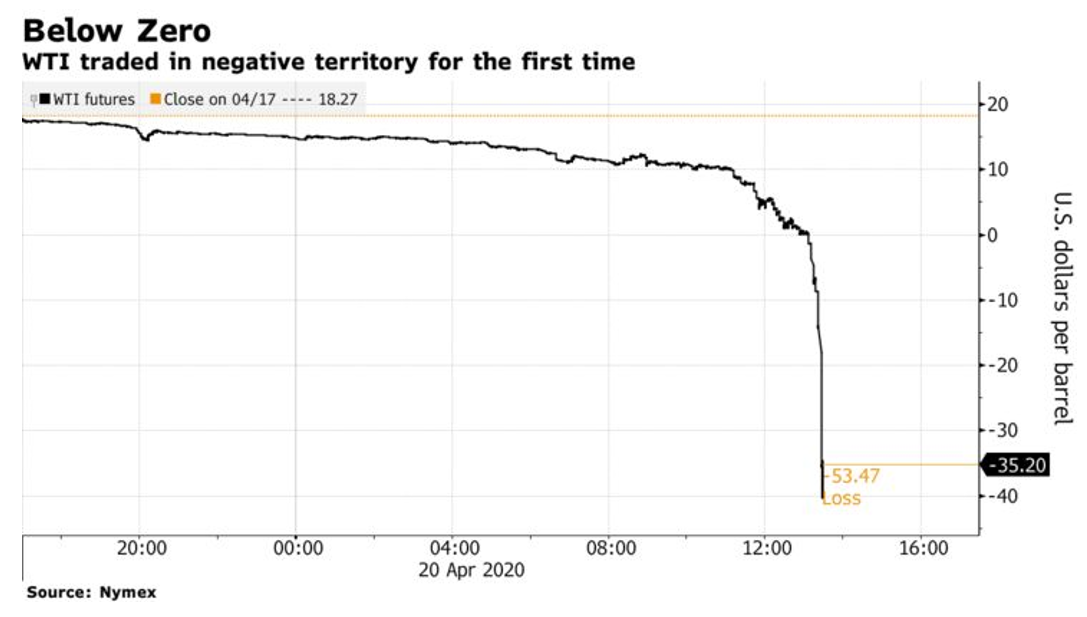

The Covid-19 pandemic stopped the global economy, and the price of future contracts for West Texas Intermediate crude oil, in May plunged into unprecedented negative territory. Brent and other pricing benchmarks also fell. Energy companies and distributors have no place to store oil, and there is no interest in crude contracts that require delivery, regardless of low price. “Underscoring just how acute the concern is over the lack of immediate storage space, the price on the futures contract due a month later settled at $20.43 per barrel,” reports a team with Bloomberg. “That gap between the two contracts is by far the biggest ever.” Governments consider how to gradually reopen economies, with little guarantee of a fast return to normality as many consumers could self-isolate to avoid infections. The price collapse began when Saudi Arabia and Russia failed to agree on production cuts in early March to stabilize prices, and the agreement in April came too late. Commodity traders, worried about “catastrophic default,” balk at extending credit. Oil companies continue to drill for oil, not wanting to lose market share to competitors. – YaleGlobal

Unprecedented Wipeout for Oil: Bloomberg

A lack of storage capacity and the Covid-19 pandemic force the price of oil to collapse below zero; commodity traders worry about catastrophic default

Monday, April 20, 2020

Read the article from Bloomberg about the drop in oil prices.

Javier Blas, and Elizabeth Low contributed to this article.

Bloomberg

©2020 Bloomberg L.P. All Rights Reserved