Europe Pursues Digital Tax After US Pulls Plug: FT

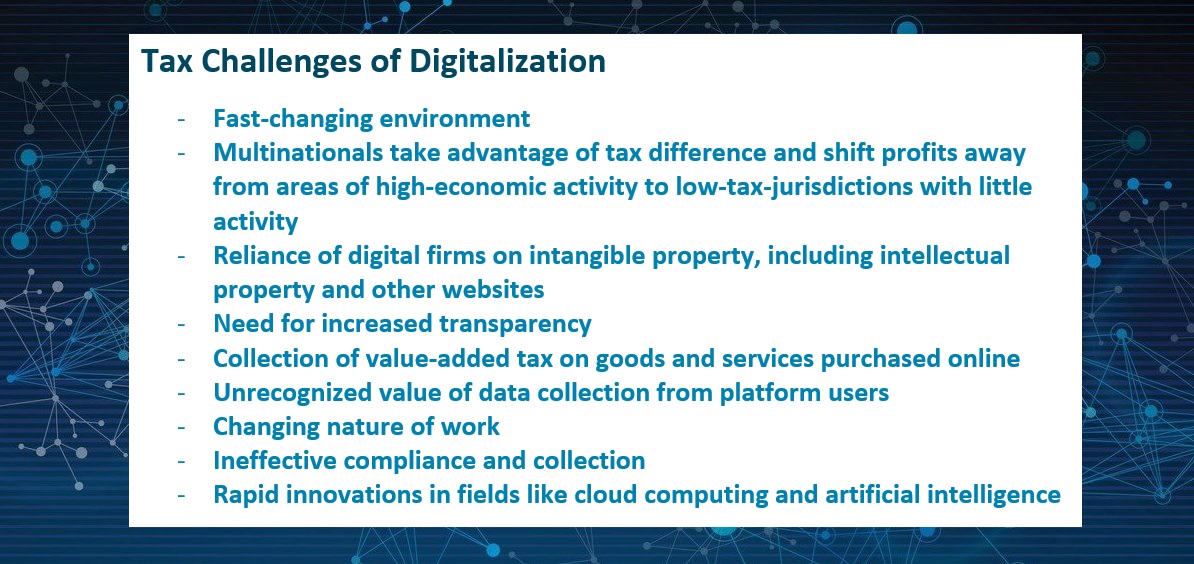

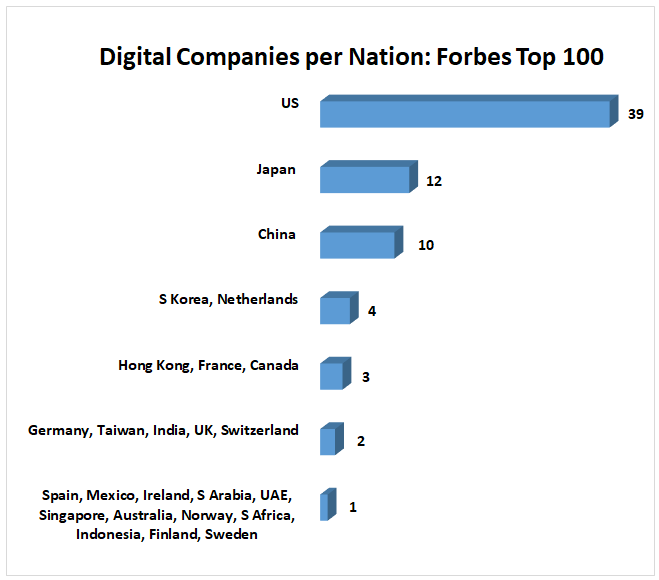

The United States walked away from global negotiations led by the OECD on a digital tax for multinationals, claiming an “impasse,” and threatened tariffs against nations that impose such taxes. “The move heightens transatlantic tensions, with the threat of more trade disputes as individual countries pursue their own taxation plans,” reports a team for Financial Times. “Robert Lighthizer, US trade representative, has already announced a probe into whether digital tax measures in the UK, Spain, Italy and other countries amount to an unfair trade practice, which would allow Washington under US law to unilaterally slap tariffs on imports from the countries involved.” EU and UK officials preferred US participation but announced plans to proceed with modernizing the tax code, and analysts anticipate a mix of new national taxes. France had suspended collection of its new tax during negotiations, planning to waive liabilities once agreement was reached. The UK launched a tax in March with collections from multinationals to begin in 2021. The OECD had proposed a compromise allowing nations to tax profits on sales within their jurisdictions and setting a global minimum corporate tax rate to stop an ongoing race to the bottom and reduced tax revenue for all. – YaleGlobal

Europe Pursues Digital Tax After US Pulls Plug: FT

US walks away from negotiations on digital tax; Paris, London and Brussels report they consider how to tax multinationals despite threat of trade war

Thursday, June 18, 2020

Read the article from Financial Times about plans by European nations for a digital tax.

Sam Fleming is Brussels bureau chief for the Financial Times. Jim Brunsden is EU correspondent. Chris Giles became economics editor for the Financial Times in October 2004, having previously served as a leader writer. His reporting beat covers global and UK economic affairs and he writes a UK economics column fortnightly. Victor Mallet is a journalist, commentator and author with more than three decades of experience in Europe, Asia, the Middle East and Africa. He is currently Paris bureau chief for Financial Times, and has written books on the River Ganges and on the modernization of south-east Asia.

Financial Times

Copyright The Financial Times Limited 2020. All rights reserved.