Fortune: US Deep in Debt

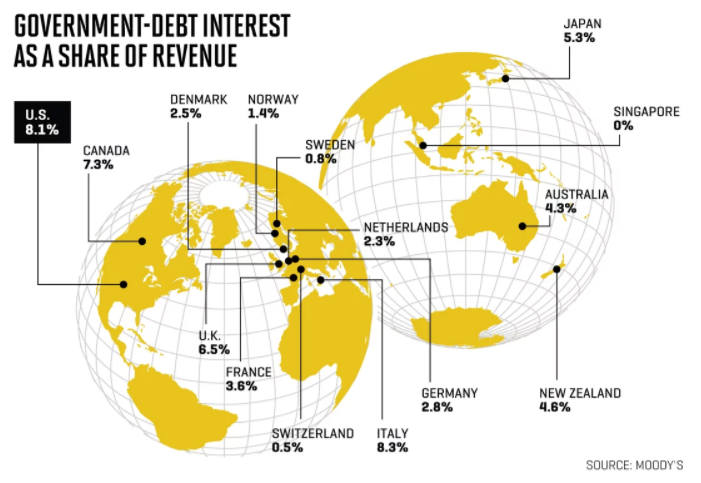

A rising US stock market hinges on a treacherous mound of debt growing due to recent tax cuts for corporations and workers. “The U.S. government’s huge and growing budget deficits have become gargantuan enough to threaten the great American growth machine,” writes Shawn Tully for Fortune magazine. “On our current course, we’re headed for a morass of punitive taxes, puny growth, and stagnant incomes for workers.” A growing share of US revenue must be directed to debt payments. Analysts predict increased risks, reduced company profits, rising interest rates, investors avoiding Treasures and decreased revenues for education, infrastructure and social services. Interest on debt is the fastest growing part of the federal budget. Inflation or wars would compound the challenges. Foreign lenders own almost 40 percent of US Treasury debt, and the United States cannot take the low-cost loans for granted. The US imposing tariffs on imports and tightening immigration policies will limit growth. Possible solutions include taxes on carbon, employer-provided health plans or consumption. Tully describes a downward spiraling cycle of servicing US debt, and delaying reforms will exacerbate the country’s economic challenges. – YaleGlobal

Fortune: US Deep in Debt

The US ignores its growing debt that will lead to increased risks, reduced profits, higher interest rates and reduced security

Tuesday, March 20, 2018

Read the article from Fortune about growing US debt levels.

Fortune

© 2018 Time Inc. All Rights Reserved.