Not Disclosing ESG Data: Wall Street Journal

Not Disclosing ESG Data: Wall Street Journal

Read the article from the Wall Street Journal about companies facing investor backlash when they do not release environmental, labor, governance, supply chain and other social impact data quickly.

Maitane Sardon is a Wall Street Journal reporter in Barcelona.

Also, read the Global Sustainable Investment Review 2018 from the Global Sustainable Investment Alliance:

“Sustainable investing is an investment approach that considers environmental, social and governance (ESG) factors in portfolio selection and management. For the purpose of this global report and for articulating our shared work in the broadest way, GSIA uses an inclusive definition of sustainable investing, without drawing distinctions between this and related terms such as responsible investing and socially responsible investing. This report primarily uses the term sustainable investing.

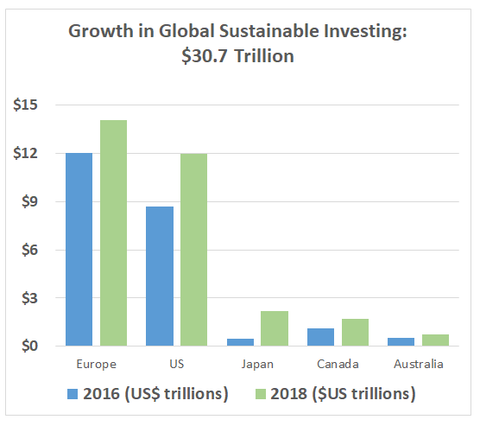

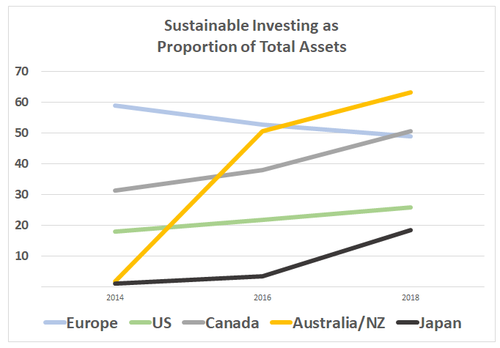

“Sustainable investment assets are continuing to climb globally, with some regions demonstrating stronger growth than others within their local currencies….

“The largest sustainable investment strategy globally continues to be negative or exclusionary screening.”

(Source: Global Sustainable Investment Review 2018)

The report suggests Europe’s decline in sustainable investments is partly due to stronger standards and definitions (Source: Global Sustainable Investment Review 2018 )