Russia vs Saudi Arabia: Reuters

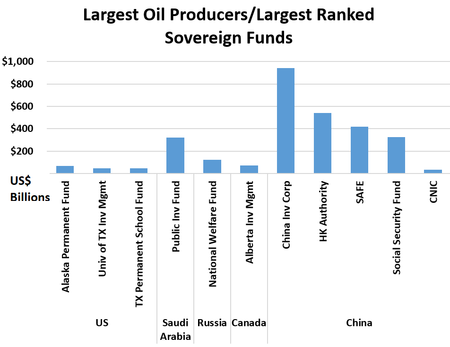

OPEC nations failed to reach agreement with a group of non-OPEC nations led by Russia to limit oil production and, in defiance, Saudi Arabia approved opening the pumps for full production, forcing prices to plummet. Stock prices of major oil companies also fall. Saudi Arabia and Russia have large financial cushions, but other countries and oil companies with debt could struggle. “The world’s top two oil exporters each have war chests of around $500 billion to weather economic shocks and are making bullish noises about their stamina as they square up,” reports Reuters. “The problem for Riyadh is that sustained low oil prices could likely constrain government spending on projects that are part of the crown prince’s drive to diversify the economy.” Moscow and Riyadh each suggest they can withstand oil prices of about $30 per barrel for a few years with adjustments. With increased production, each nation can pursue increased market share, adding pain for US shale producers and drive firms in high debt out of business. The US Energy Department has postponed a scheduled sale from the government’s Strategic Petroleum Reserve to prevent adding to a market already over-supplied. – YaleGlobal

Russia vs Saudi Arabia: Reuters

Russia and Saudi Arabia resist agreement on reducing oil production levels, pressuring global oil prices downward

Tuesday, March 10, 2020

Read the article from Reuters about oil-producing nations’ failure to agree on production levels.

Additional reporting by Gabrielle Tétrault-Farber, Andrew Osborne, Andrey Ostroukh, Elena Fabrichnaya and Rania El Gamal.

Also read “US Postpones Sale From Strategic Petroleum Reserve” from the Wall Street Journal.

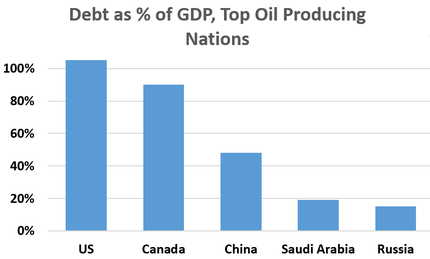

Debt load: Low reliance on debt could help nations and companies with low debt survive a spell of low oil prices (Source: Top oil nations, Investopedia; debt, Trading Economics)

Support: Sovereign wealth funds for oil-producing nations and US states can help during times of low prices - asset prices are from about 2018 and do not reflect recent market drop (Source: Top oil nations, Investopedia; wealth funds ranked, SWFI)

Reuters

© 2020 Reuters. All Rights Reserved.