US Energy Independence Is Dying: OilPrice.com

As COVID-19 spread worldwide, Saudi Arabia and Russia failed to agree on oil production limits. Russia suggested it would slash production only if the United States did likewise, putting a dagger into any notion of US energy independence. Many US firms reject a deal with OPEC or Russia. Production continues, global oil storage is running out; the US economy remains dependent on fossil fuels and exports and cannot control prices. The US oil industry lobbies the Trump administration to impose sanctions and tariffs on oil imports. “Although last week Saudi Arabia lashed out at Russia for allegedly unjustly accusing Riyadh of playing against U.S. shale, weaker U.S. shale is even better for the Saudis than it is for the Russians,” writes Irina Slav for OilPrice.com. “The former have a higher breakeven price than the latter and are more vulnerable to competition from the United States. If OPEC+ now agrees to cut production without asking the U.S. to do the same, it would effectively hand over the crown of the global oil decision-maker to Washington.” The Saudi accusation led to cancellation of a virtual OPEC meeting. The pandemic disrupts economies indefinitely, keeping energy demand low. – YaleGlobal

US Energy Independence Is Dying: OilPrice.com

Russia refuses to reduce oil production levels with Saudi Arabia unless the United States goes along – putting US energy independence into question

Wednesday, April 8, 2020

Read the article from OilPrice.com about the challenge of low oil prices for the US shale industry.

Irina Slav is a writer for Oilprice.com with over a decade of experience writing on the oil and gas industry.

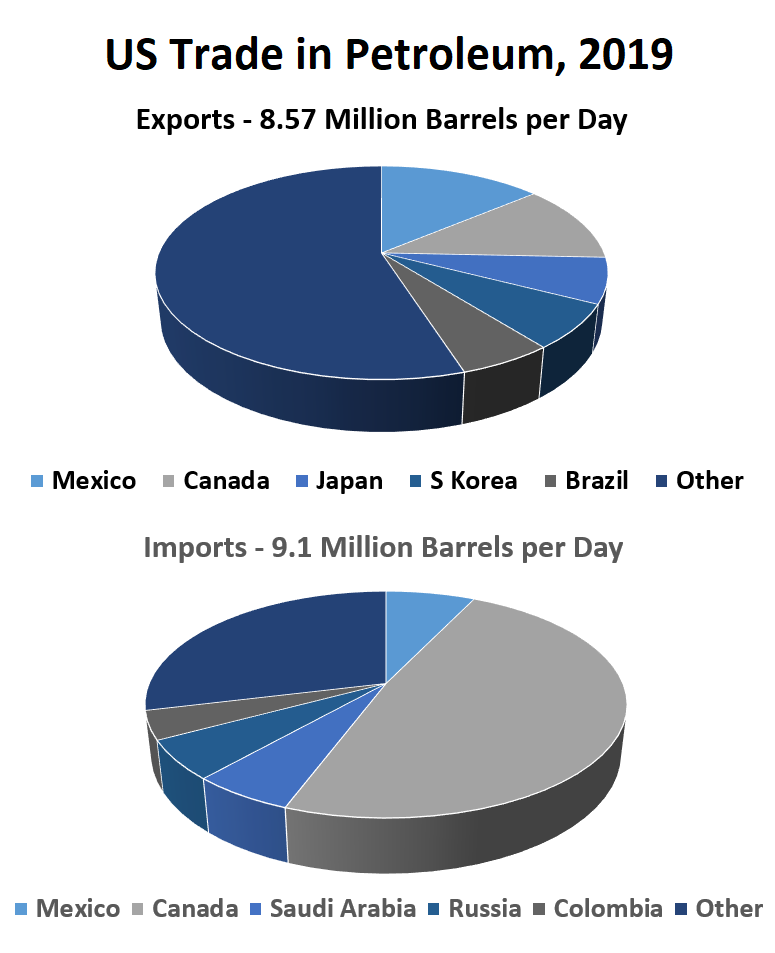

(Source: US Energy Information Administration)

OilPrice.com

© OilPrice.com