US Moves to Audit Chinese Firms: WSJ

US Moves to Audit Chinese Firms: WSJ

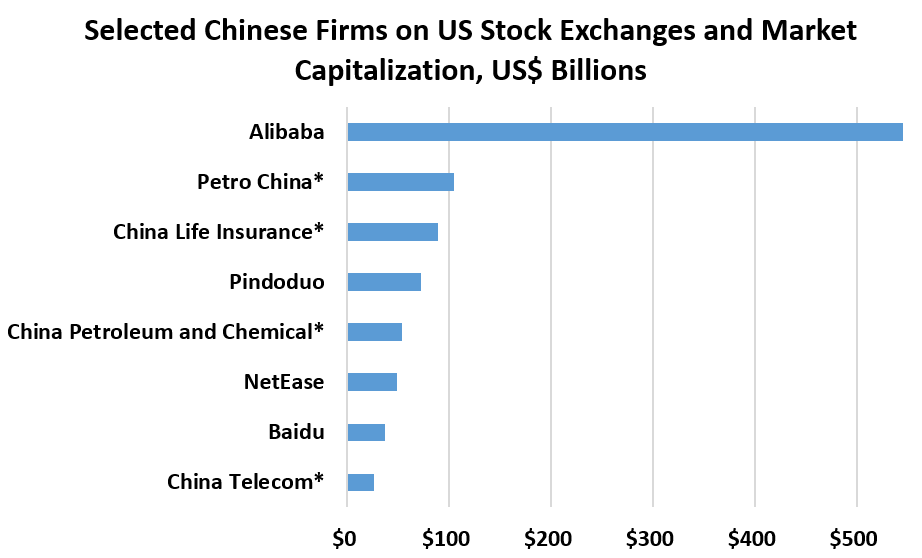

Read the article from the Wall Street Journal about a US proposal to extend regulatory requirements to Chinese firms listed on US stock exchanges.

Dave Michaels is a reporter in The Wall Street Journal's Washington bureau covering white-collar crime and financial enforcement.

Akane Otani is a reporter for The Wall Street Journal in New York, where she covers the U.S. stock market and investing. Prior to joining the Journal, she was a higher education reporter at Bloomberg Businessweek in New York.

Sebastian Pellejero contributed to this article.

Also read the article from the Wall Street Journal about Chinese firms that may decide to delist themselves from US stock exchanges.