Saudi Arabia’s Aramco IPO and Peace: Ozy

Trade is supposed to help secure peace, though trade in oil has been linked to war. So analysts mull over Saudi Arabia’s plans for the world’s largest initial public offering. The Saudi Aramco IPO announcement followed soon after the September 14 drone attack on a refinery in Abqaiq. Investors expect stability and so Saudi Arabia, unlike the United States and Israel, did not rush to blame Iran. “It was one among a series of moves by Saudi Arabia that experts say point to its desire not to inflame regional tensions at a time it’s desperately seeking investments in Aramco, the world’s most profitable firm,” reports Sanjay Kapoor for Ozy. “To be sure, the attempts at peace from both sides — Saudi Arabia and Iran — are temporary at best and linked to their immediate needs.” Iran struggles with US sanctions and political unrest while Saudi Arabia recognizes that the United States is withdrawing from the region. Russia builds influence in the region, and both Saudi Arabia and Iran pursue good ties. The Aramco IPO will contribute to peace if conflict subsides and benefits are spread regionally. Analysts value the IPO at $1.7 trillion, but peace in the region is priceless. – YaleGlobal

Saudi Arabia’s Aramco IPO and Peace: Ozy

The Saudi Aramco IPO and economic opportunities could provide a calm that allows negotiations and détente between Middle East rivals Saudi Arabia and Iran

Thursday, November 28, 2019

Read the article from Ozy about the Saudi Aramco IPO.

Read the policy brief “Oil, Conflict, and U.S. National Interests” by Jeff Colgan from Quarterly Journal: International Security.

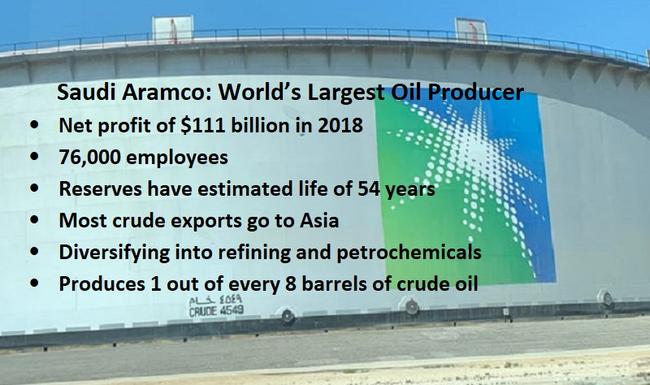

(Source: Saudi Aramco and Economic Times)

Ozy

© OZY 2019 - Terms & Conditions