Global Retirement Ages Creep Higher: CNBC

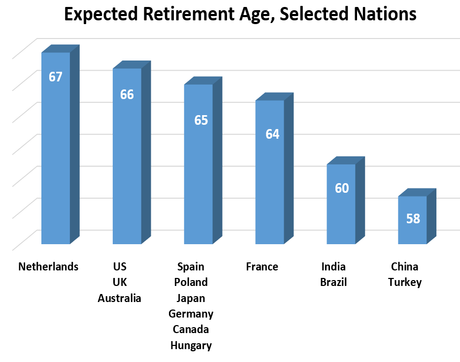

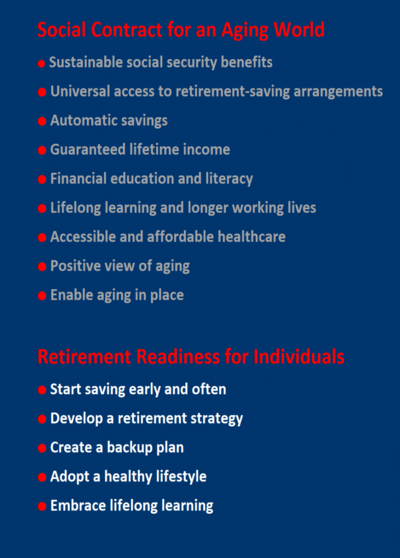

Life expectancy is higher worldwide, and governments and individuals respond by hiking the retirement age. “Fueled by changes in lifestyles, working practices, diet and medical advances, people living today can expect to live up to 30 to 40 years longer when compared with people at the beginning of the 20th century,” notes the Aegon Retirement Readiness Survey. A majority of US workers plan to work beyond age 65. “In the U.S., according to the Social Security Administration, full retirement age for individuals born in 1960 and later is 67,” reports Lorie Konish for CNBC. “The Netherlands is already at 67, while France, Spain and Poland all have plans to move towards that age.” Reasons for delaying retirement range from not having enough savings to finding pleasure in colleagues and work activities. Workers also express concerns about traditional safety nets, with 75 percent of those in the United expressing concerns about the government ending or reducing Social Security before they reach retirement. – YaleGlobal

Global Retirement Ages Creep Higher: CNBC

More retirees around the world plan on working past age 65, and governments plan retirement programs around higher ages – individuals must prepare

Saturday, February 15, 2020

Read the article from CNBC about individuals and government preparing for higher retirement ages.

Lorie Konish is a reporter covering personal finance at CNBC.com.

(Source: Aegon Retirement Readiness Survey 2019)

CNBC

© 2020 CNBC LLC. All Rights Reserved. A Division of NBCUniversal